What's goin' down?

Oh, hi there! Funny seeing you down here.

You’re probably here because someone told you to come. Nice to see you!

Down the garden path is a small group of founders being shepherded through the nightmare journey of building a startup from scratch by a handful of repeat and exited entrepreneurs.

Our ‘troop’ enjoys a whole bunch of things to make the journey less lonely. From a dedicated community with an ‘ask me anything’ approach to support; to a whole set of videos on ‘hacks’ to raising money from investors.

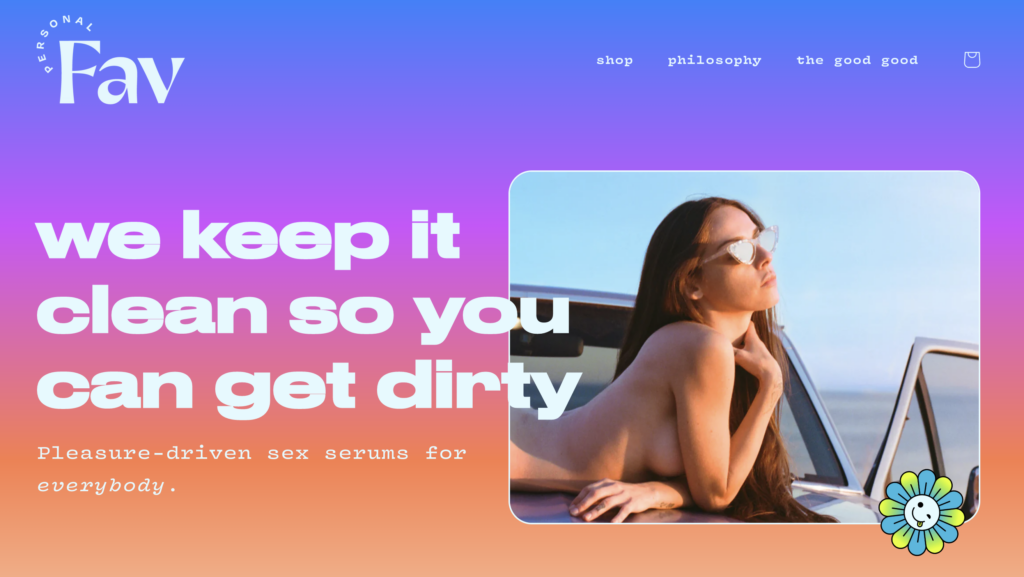

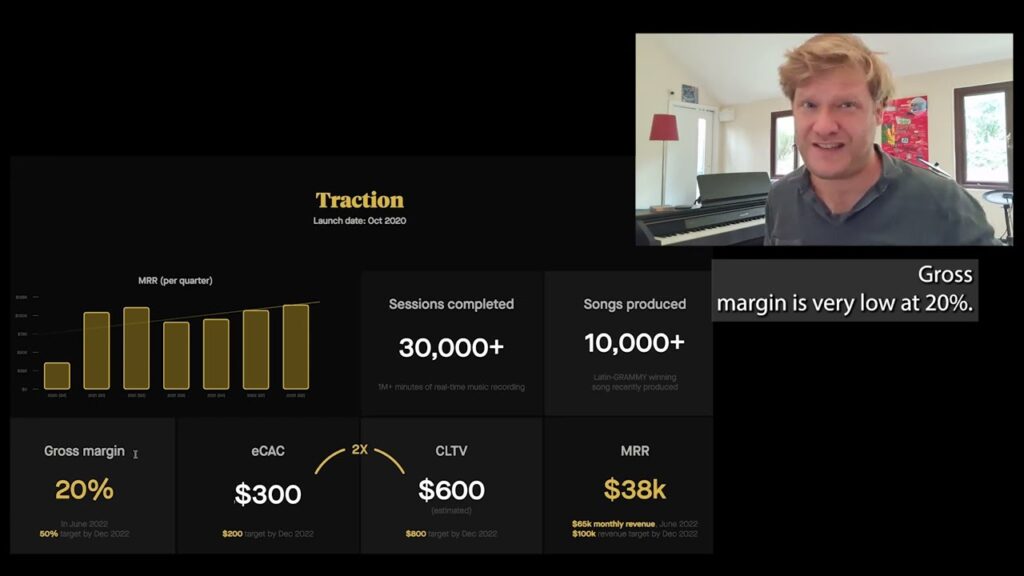

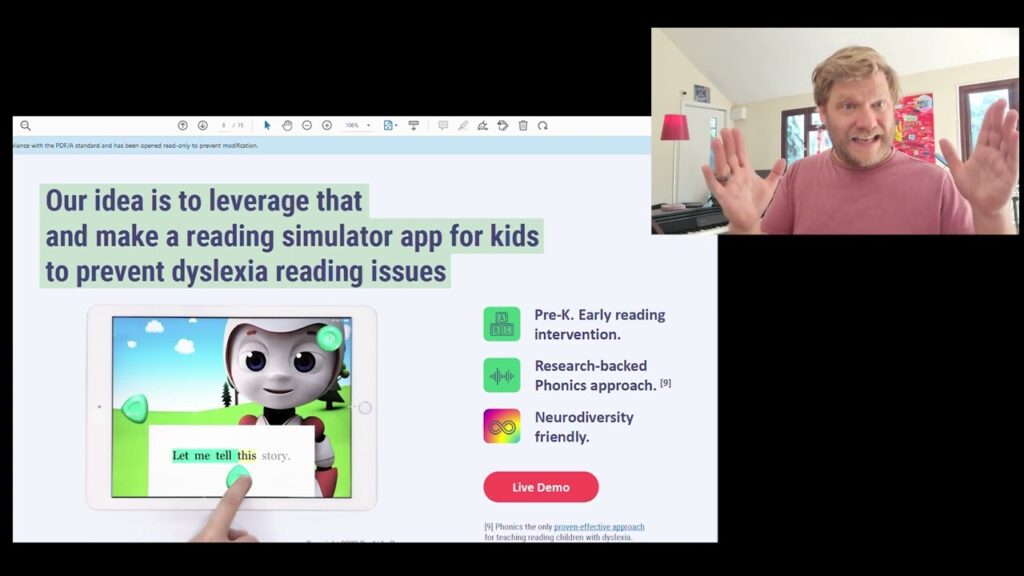

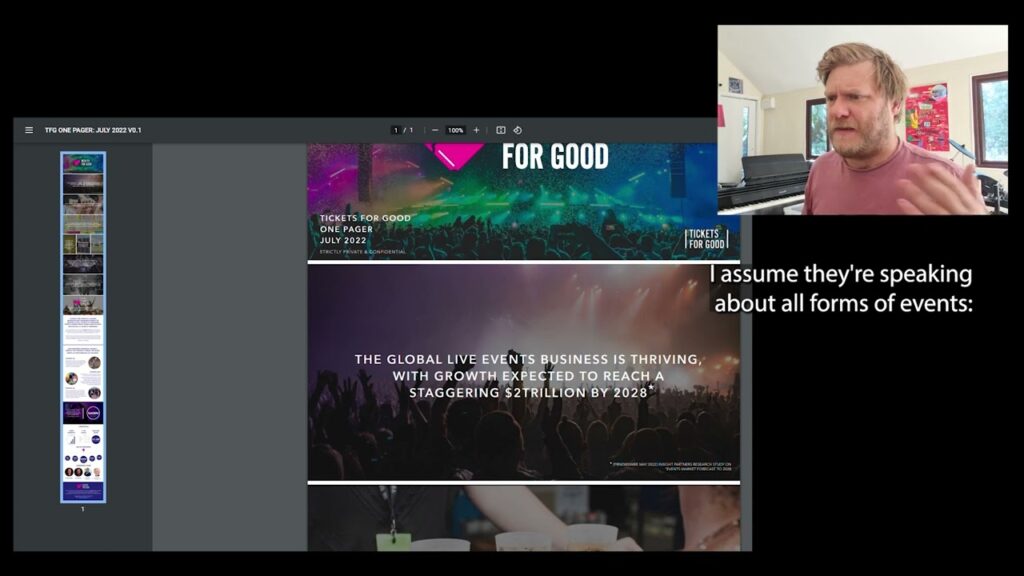

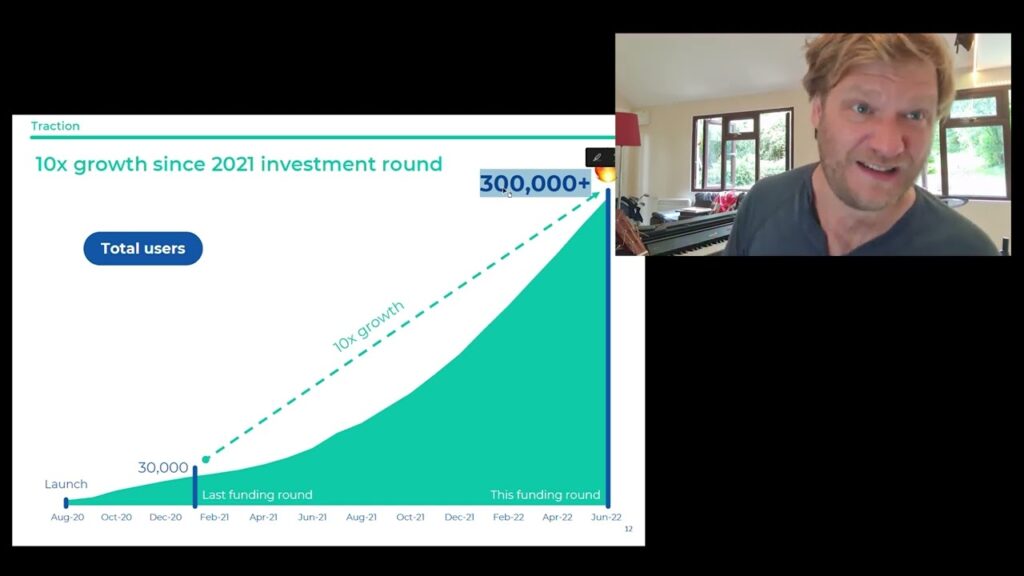

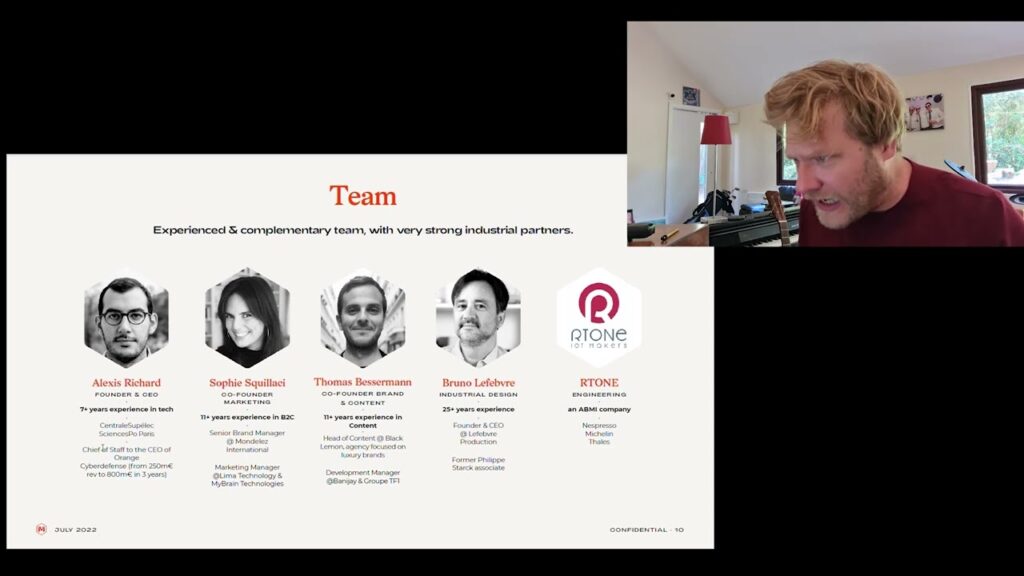

If you want in too, you’re going to do a cold read. It’s real simple. You give us a pitch deck (it can be draft, rough, whatever…) and we ‘unbox it’ – saying everything out loud a good investor might *think* about your deck, but never ever tell you. To get one, head to my LinkedIn, follow, and then ping me a DM.

Do that, and you’re invited to the gang. Simplez. There’s over 100 of us already, and watch below if you’re unsure…