Cold Read – Tickets for Good

PITCH DECK COLD READ TIME! Here we have a fine example of a founder attempting to create a new and novel kind of #pitchdeck , but it failing totally and miserably 🙁 Watch the video to see how… Oh dear 🙁 In this Cold Read, we have Tickets for Good – an events ticket reseller […]

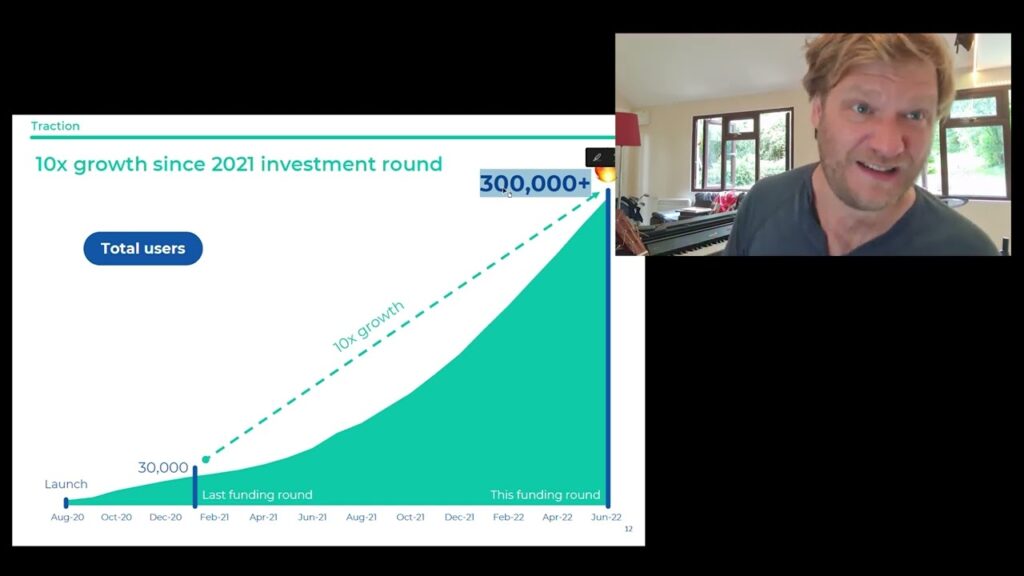

Crowdcube Pitch Review – Howbout – August 2022 (Full Version)

This is the full version review of the Howbout pitch deck on Crowdcube (https://www.crowdcube.com/companies/h…) In short, a good deck – but 4 really important unanswered questions… 1) How do they see investors getting a return? It’s not clear in their financial model 2) User growth – numbers are good but only if it’s retention 3) […]

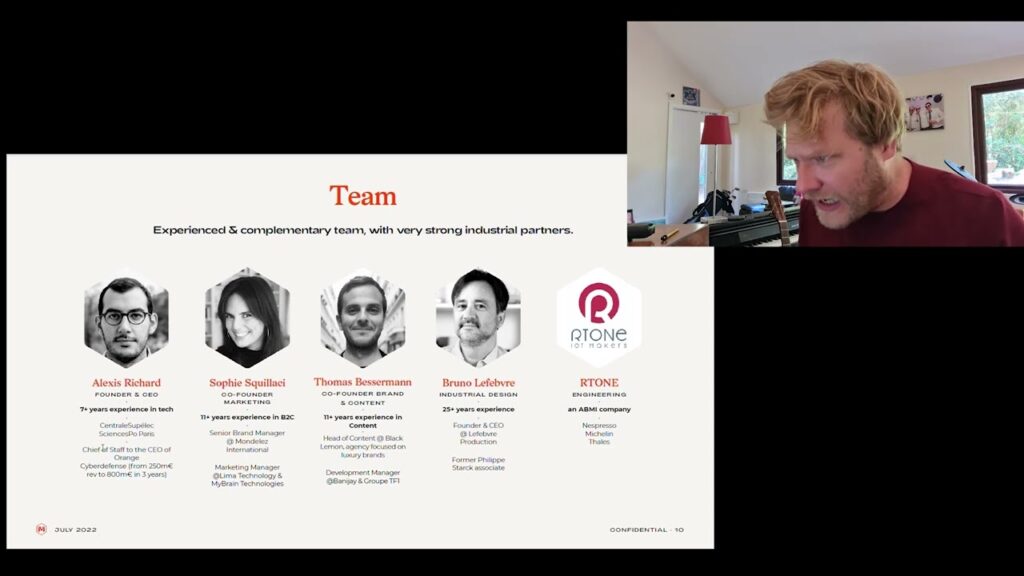

Crowdfunding Pitch Review – Montvel – A French-made Pellet Barbeque (Full Version)

This time around on our ‘Q&A for Crowdcube’ series, we have Montvel – a BBQ & Pellet Fuel company from France. Now, to some, not the most glamerous of industries/products – but you can be sure that, until the Star Trek replicator is invented, people will always spend money on home-cooking. So, glamerous or not, […]

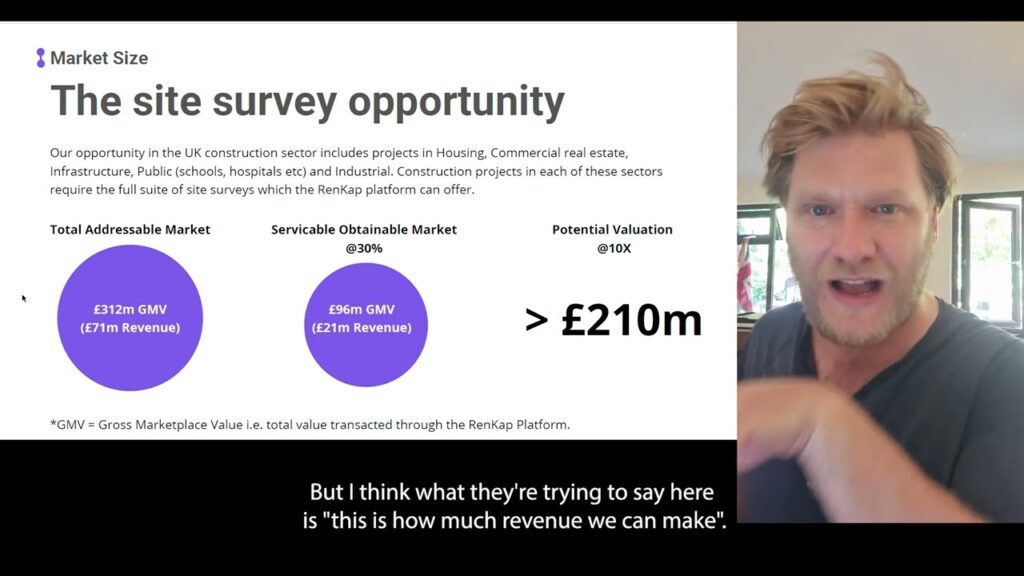

Cold Read – Renkap – Construction Industry Pre-site Survey Tech

This one is a beauty of a cold read. What we have, across 5 minutes, is some of the best things to do in a pitch deck, and some of worse. Here’s my ‘ranking’ of this deck: If I were a VC: I’d have to say no and not take the intro 🙁If I were […]

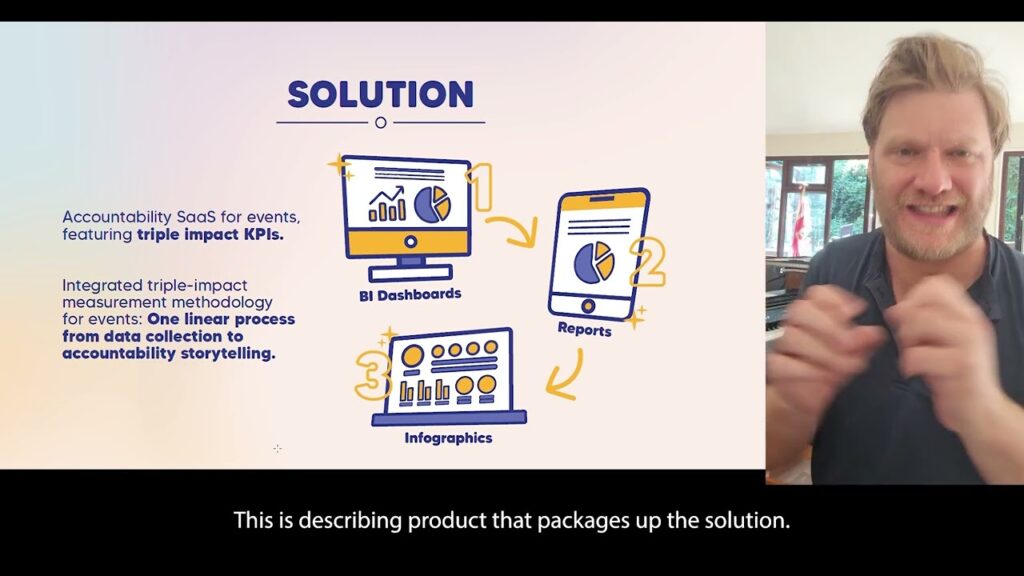

Cold Read – Measurevent – a ‘impact analytics’ company for live events

Aaaaaaaaaaand here we go again! This time it’s a pre-seed company called ‘Measurevent’ cofounded by local Chilean, Félix Barros . This deck is a beauty… it has a fantastic example of how to open a pitch deck to build confidence and interest (woo!) but it also is a fantastic example of what NOT to do […]

Cold Read – Anthill – A Web3 Collective for Artists & Fans

This time, it’s Antill – founded by former The Rattle team member, Gigi Piscitelli! Now, usually, I try and make sure I have no prior knowledge of the startup before recording my cold read. But on this occasion, I already knew the ‘grand plan’. However, I had never seen a deck before or really been […]

Cold Read – Decibels – Hearing Enhancers

Decibels – a hearing enhancement technology company. I had never seen this deck nor know anything about the company before seeing this deck. Where this deck fails is that there is a discrepancy between the problem the company Decibels is attempting to address, and the problem the product Decibels is attempting to address. This is […]

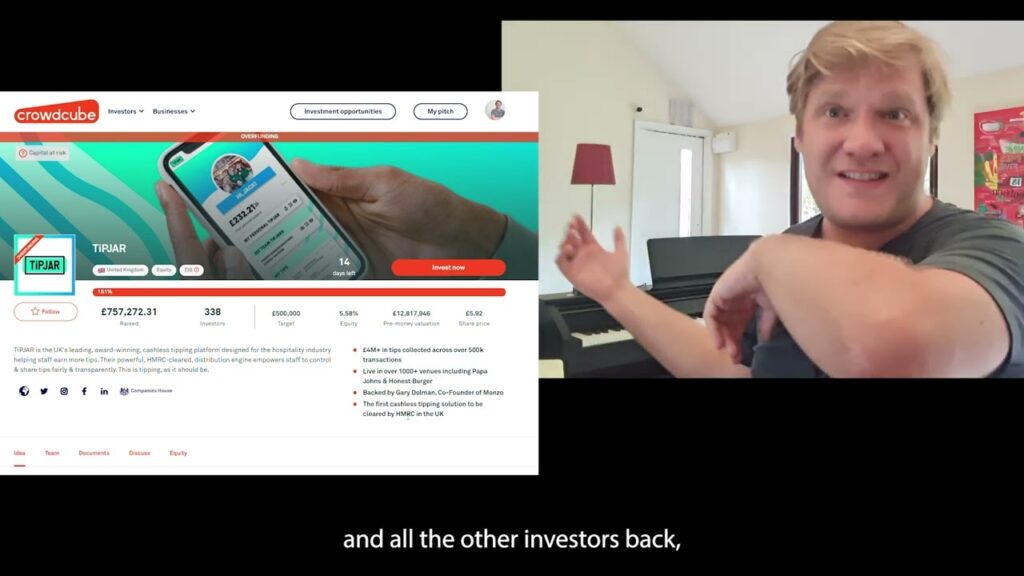

How to understand a Crowdfunding pitch like a real investor

Here’s how to read past the BS on #Crowdfunding #pitch pages. How Crowdfunding is gamed, and how it works behind the scenes. I share what I look out for when I’m looking to invest, what I ignore, but more importantly – WHY I do those things.